Join over 13,000 people like you — working in public and private sector jobs in finance, transit, IT, transportation, Crown corporations, security and other office and professional sectors — and enjoy the benefits of our collective strength.

Fund Transit NOW!

We must ensure our healthcare and other depended upon front-line workers, and the most vulnerable in our society, can get to where they need safely, affordably, and conveniently.

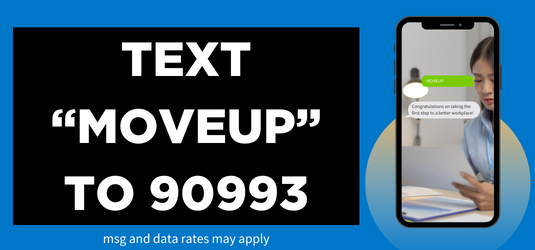

Text “MOVEUP” to 90993

Need a union? Text “MOVEUP” to 90993. A better workplace is just a text message away.

Find My Workplace / Contract

Click on the logos below or search your employer name to find your collective agreement, your union representative(s), or the latest workplace bulletins.

The Latest

Meet Your Union

Brenda sits on the executive board, co-chairs several MoveUP committees, and is a trustee of the BCFED.

Check out the latest issue of Local Voice

Highlights from this issue:

- Every union member a voter

- Member profiles

- Mental health education

- Ed Broadbent memoir

- David Black retrospective

Connect with our communications department, connect with us on social media, and download the union bug.